Income Statement

The income statement, also known as a profit and loss (P&L) statement, is a financial report summarizing a company’s revenue, expenses, and profitability over a period of time.

What is the Income Statement?

The income statement is one of the three financial reporting statements that small business owners and entrepreneurs should understand. The other two are the balance sheet and the cash flow statement. Also referred to as a profit and loss statement (P&L), it’s a financial tool that reports the performance of a business by summarizing revenue, expenses, and net income or loss for a specific period, usually a month, quarter, or year.

Reviewing the income statement regularly helps management and ownership understand the company’s performance over time. As small business owners get more familiar with their income statement, they’ll be able to identify areas of high expenses and evaluate the effectiveness of their revenue-generating activities. These reviews allow leadership to spot trends and make informed strategic decisions to take advantage of opportunities and address challenges.

The following article discusses the income statement in detail, including the components, why it’s important to small businesses, effective analysis of the data, and maintaining an accurate income statement.

Key Discussion Points

The income statement is a critical financial tool that offers a breakdown of a company’s revenue, expenses and net income, providing small business owners with a clear picture of financial performance.

The key components of the income statement are revenue (sales), cost of goods sold, gross profit, operating expenses, operating income, non-operating income and expenses, interest, taxes, and net income.

Conducting regular reviews of the income statement is important, providing small business owners with the ability to assess financial sustainability, identify trends, establish benchmarks, and improve the odds of securing financing when needed.

Utilizing KPIs can enhance the insights business leaders glean from the income statement by providing additional information about operational efficiency, solvency, growth rates, and other trends.

Maintaining an accurate income statement is critical for providing value to leadership; utilizing accounting software, prioritizing accurate record-keeping, conducting regular reviews, and getting expert assistance are all great ways to ensure the integrity of the income statement remains intact.

Why the Income Statement is Important for Small Businesses

The income statement is highly important for any small business owner or leader. Also called the profit and loss (P&L) statement, it provides a clear picture of a company’s financial performance by summarizing revenues, expenses, and resulting net income (profit) or net loss.

Below, we explore the significant insights and benefits of maintaining and regularly reviewing the income statement with key business leaders.

Benchmarking - Income statements can be used for benchmarking a small business's performance against industry averages or competitors. This allows them to see how they stack up financially and identify areas for improvement.

Financial Sustainability - Regularly monitoring income statements enables businesses to track their performance over time and assess their long-term financial health. Early identification of potential shortfalls allows for timely adjustments to ensure long-term sustainability and growth.

Identifying Trends - By analyzing income statements over time (monthly, quarterly, annually), small businesses can identify trends in their revenue and expenses. This can reveal areas where the business is consistently performing well or areas that might require adjustments. For example, a seasonal business might see a predictable dip in revenue during certain months, allowing them to plan for these fluctuations.

Improved Financing Terms - When applying for loans, small businesses will typically be required to submit their income statements. A strong income statement with consistent profitability can significantly improve the chances of securing a loan with favorable terms.

Investor Confidence - Transparent and accurate income statements are essential for building trust with investors and lenders. By showcasing a company's ability to generate profits and manage expenses effectively, businesses can attract necessary investment for future growth initiatives.

Revenue Utilization - Understanding how revenue is allocated to operational resources is critical for small business owners to ensure resources are properly allocated to optimize organizational efficiency. Analyzing the percentage of revenue allocated to each business activity helps management understand that activity’s impact on the business and make smarter resource allocation decisions.

Tax Strategy - Income statements play a crucial role in tax planning for small businesses. By analyzing their income and expenses, businesses can estimate their tax liability and make informed decisions about deductions and tax-saving strategies.

Offering a clear picture of revenue streams, expenses, and profitability trends, the income statement empowers businesses to optimize resource allocation, secure financing with favorable terms, and develop effective tax strategies.

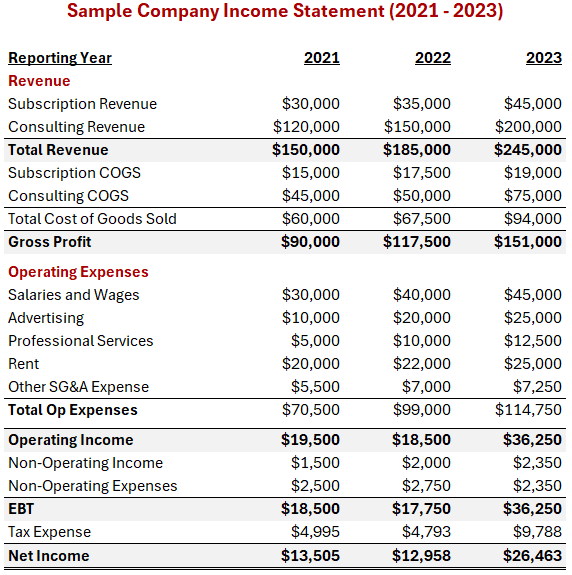

The comprehensive income statement logically reports the following components: sales or revenues, cost of goods sold, gross profits, operating expenses, non-operating income and expenses, taxes paid, and net income. As you can see in the image below, the income statement makes it very easy to see how the revenue a company generated was used in its operations during a month, quarter, or year - whichever period is being reported.

Let’s take a deeper look at each of the income statement components to understand how your business activities are captured in this document:

Revenue/Sales

Revenue, also called sales, represents the total income a business generates from selling goods or services related to the business’s primary activities during a specific period. It’s important that all reported revenue and sales are related to primary sales activities; other unrelated revenue, such as the sale of equipment or other assets at the end of their useful life, gets reported as non-operating income.

Sources of revenue can vary depending on the nature of the business but commonly include:

Sales of Goods - Revenue generated from selling products manufactured or purchased by the business

Provision of Services - Revenue generated from providing services to clients or customers

Subscription Fees - Revenue generated from recurring payments for subscription-based products or services

Licensing and Royalties - Revenue generated by granting other organizations or individuals the rights to use intellectual property, such as patents, trademarks, or copyrights, in exchange for a fee (licensing) or a share of the revenue earned (royalties)

Rental Income - Revenue generated from leasing out property, equipment, or other assets

Advertising Income - Revenue generated from selling advertising space or services on websites, platforms, or media channels

Commission Income - Revenue generated from facilitating transactions as an intermediary between two or more parties, such as a real estate agent or broker

Grants and Contributions - More common for non-profit or research-based organizations, this is revenue received from government programs, donations, or other contributions from individuals or organizations

Cost of Goods Sold (COGS)

The cost of goods sold (COGS) is the money a business spends on all activities related to purchasing and manufacturing the products it sells. COGS generally consists of raw materials, direct labor, and manufacturing overhead costs. The cost of goods sold generally does not include marketing, sales, distribution or other operating costs.

COGS is subtracted from revenue to calculate a company’s gross profits and margins. The higher a company’s COGS is, the lower its gross profit will be, and vice versa. Business owners must manage COGS effectively to create the highest potential profitability. When done correctly, successful COGS management could lead to a sustained cost advantage over industry competition.

Gross Profit

As mentioned above, gross profit is the difference between a company’s total revenue and the cost of goods sold. When expressed as a percentage of revenue, gross profit becomes gross margin. Gross margin is a great benchmark for analyzing your company’s performance relative to the rest of the industry. In the income statement example above, 2023 gross margin was 62% ($151,000/$245,000).

Gross Profit = Revenue - Cost of Goods Sold

Gross Margin = Gross Profit / Revenue * 100

Gross profit is important for business owners to understand because it represents the amount of money that remains after manufacturing and delivering goods and services to cover other operating costs such as salaries, wages and benefits, utilities, rent, marketing and advertising, etc.

Operating Expenses

Operating expenses are the ongoing costs associated with running the business. These tasks must be completed each day for the business to operate successfully. They don’t include expenditures related to investments or interest payments on loans for example.

Operating expenses consist of fixed costs and variable costs. Fixed costs stay the same regardless of sales activity while variable costs will change with changes in sales activity. Understanding fixed and variable costs is critical to knowing the break-even point.

The objective of the leadership team should be to minimize operating expenses without impairing the organization’s ability to generate revenue. Common operating expenses include:

Salaries, wages, and benefits for employees

Advertising and marketing expenses

Rent or lease payments

Utility expenses

Repairs and maintenance

Office supplies

Legal and professional fees

Insurance premiums

Travel and entertainment expenses related to business activities

Operating Income

Operating income is the profit earned from core business activities after deducting operating expenses from the gross profit. Operating income shows how much money a company makes from its main operations after covering costs directly associated with those operations. When expressed as a percentage of revenue, operating income becomes the operating margin. In the example income statement above, the operating margin in 2023 was 15% ($36,250/$245,000).

Operating Income = Gross Profit - Operating Expenses

Operating Income = Revenue - COGS - Operating Expenses

Operating Margin = Operating Income / Revenue * 100

Operating income is also known as Earnings Before Interest and Taxes (EBIT). Because interest income and expenses are related to investing and financing activities, interest is not factored into operating income. Since taxes are not costs incurred as part of operating the business, they are also not part of the operating income calculation.

Non-Operating Income and Expenses

Non-operating income and expenses refer to money the business earns or spends from activities unrelated to the primary business operations. These activities generally involve interest income from savings accounts or other holdings, interest expense payments made on borrowed funds, or gains (income) or losses (expense) from selling assets such as property or equipment the business no longer uses.

Some other non-operating items include:

Foreign exchange gains (income) or losses (expense)

Insurance proceeds (income)

Legal settlement gains (income) or losses (expenses)

Dividend payments received (income)

Restructuring costs (expense)

Charitable donations and contributions (expense)

Taxes

Businesses are subject to various tax obligations depending on their operations. For small businesses, it’s generally advised to reserve 30% to 40% of business income for tax payments. These tax obligations can include:

Income Taxes - Similar to individuals, businesses pay taxes on their profits. The federal corporate tax rate can vary by country, ranging from 0% to over 30%; factors like location, industry, and regulations can influence the applicable rate.

Sales and Property Taxes - Businesses may be responsible for collecting and remitting sales taxes on goods or services sold. Additionally, they may be subject to property taxes on owned real estate.

Payroll Taxes - These taxes fund social security and other programs; businesses are responsible for withholding and paying payroll taxes on employee wages.

Beyond federal taxes, businesses may also have state and local tax liabilities. These can arise if a business has a physical presence (office or store) or achieves a certain level of sales within a specific jurisdiction.

Business taxes are a complex subject. It's highly recommended to consult a qualified business tax adviser to ensure your company complies with all applicable regulations.

Net Income

Net income is earnings after subtracting all operating expenses, factoring in non-operating activity, and taxes from gross profit. Net income is available to repay outstanding debt, invest in new growth opportunities, retain the funds in a bank or investment account, or pay the funds out to shareholders as dividends.

When expressed as a percentage of revenue, net income is known as net margin. In our sample income statement, the company achieved a net margin of 11% in 2023 ($26,463/$245,000)

Net Income = Gross Profit - Operating Expense + Non-Operating Income - Non-Operating Expense - Taxes

Net Income = Operating Income +/- Net Non-Operating Income/Expenses - Taxes

Net Margin = Net Income / Revenue * 100

Income Statement Analysis: Key Performance Indicators (KPIs)

Conducting an income statement analysis allows small business owners to dig deep into the performance of their company and begin to further understand the drivers of overall profitability. By utilizing Key Performance Indicators (KPIs) - specific metrics applied to the income statement to reveal deeper insights - small business owners can gain valuable insights into efficiency generating revenue and managing expenses. Potential investors or financial institutions will evaluate the income statement in a similar fashion when evaluating your business.

Analyzing the income statement with KPIs allows business owners to asses various characteristics of their business operations.

Profitability KPIs

Profitability KPIs show how effectively a company generates profit from its operations. Higher percentages equal more profitability, signaling more efficient operations and better allocation of resources.

Gross Margin - shows the percentage of revenue remaining after factoring in the direct costs of producing goods and services sold (costs of goods sold)

Gross Margin = Gross Profit / Revenue * 100

Operating Margin - shows the percentage of revenue remaining after covering all operating expenses, but before interest and taxes

Operating Margin = Operating Income / Revenue * 100

Net Profit Margin - shows the percentage of revenue remaining after all expenses, interest, and taxes; this is the percentage of revenue left for the company’s owners

Net Profit Margin = Net Income / Revenue * 100

Expense Ratios - show what percent of revenue is allocated to each expense line item, the formula can be applied to any expense item to see how much revenue it consumed and if there was an acceptable return on the dollars spent

Expense Ratio = Expense Item / Revenue * 100 (Ex. Marketing Expense Ratio = Marketing Expense / Revenue * 100)

Solvency KPIs

Interest Coverage Ratio - illustrates how easily a company can pay interest on outstanding debt, also called Times Interest Earned; a higher ratio is favorable

Interest Coverage Ratio = Operating Profit (EBIT) / Interest Expense

Debt Service Coverage Ratio - shows a company’s ability to pay its debt service obligations, including principal and interest, after all operating activities are considered, a higher ratio is favorable

Debt Service Coverage Ratio = Net Income / Debt Service

Growth KPIs

Revenue Growth Rate - shows how quickly a company’s revenue is increasing (or decreasing) on an annual basis

Revenue Growth Rate = Current Year Revenue / Prior Year Revenue - 1

Operating Income Growth Rate - shows how quickly a company’s operating income is increasing (or decreasing) on an annual basis and can be compared with the revenue growth rate to understand changes in operating efficiency

Operating Income Growth Rate = Current Year Operating Income / Prior Year Operating Income - 1

Net Income Growth Rate - shows how quickly a company’s net income is increasing (or decreasing) on an annual basis and can be compared with the operating income growth rate to understand changes in interest and taxes paid

Net Income Growth Rate = Current Year Net Income / Prior Year Net Income - 1

While not an exhaustive list, the example above provides plenty of analytical power for small business owners to dive deep into their income statements and better understand their business operations.

Tips for Maintaining a Quality Income Statement

Any income statement will only be as good as the data provided and the maintenance practices employed by the company. An income statement with incorrect or missing data is useless to a small business owner with the potential to significantly damage any credibility the business may have with investors or financial institutions.

Take the following steps to create and maintain an effective, accurate income statement:

Use Accounting Software - Instead of spreadsheets, consider affordable, easy-to-use tools like Quickbooks or Xero for tracking income and expenses. These solutions automate tasks, reduce mistakes, and generate a professional-looking income statement for your business.

Prioritize Accurate Record Keeping - Keep detailed records of all cash inflows and outflows (this is one of those tasks that can be automated by Quickbooks or Xero) to ensure the accuracy of the income statement; find a system that keeps you organized with receipts, invoices, and financial documents.

Conduct Regular Reviews - check the income statement regularly, preferably monthly, with the rest of your leadership team. Consistent review familiarizes leadership with operations helping to catch any errors, discover potential issues before they become serious problems, and recognize opportunities before it’s too late to act.

Use a Professional - As your business grows and accounting becomes more complicated, or you’re not much of an accountant to begin with, consider getting advice from a professional. They can give expert guidance, help with taxes, and offer tips to manage your finances better.

The accuracy and usefulness of an income statement hinges entirely on the quality of data it's built upon. Erroneous or incomplete data can lead to misleading financial portrayals, potentially jeopardizing a small business's credibility with investors and financial institutions.

By incorporating these steps – utilizing accounting software, prioritizing record-keeping, conducting regular reviews, and seeking professional assistance when necessary – small businesses can ensure their income statements are reliable and informative, empowering them to make sound financial decisions.

The Bottom Line

The income statement is a powerful tool that unveils the financial health of your business. It helps empower small business owners to make informed decisions in all operational areas by providing a clear and comprehensive picture of financial performance.

Take your knowledge and understanding of your business even further by conducting an income statement analysis. Understanding the income statement’s components and reviewing KPIs gives small business owners a greater opportunity to gain valuable insights to develop and implement informed strategies to improve operations, capitalize on opportunities, and establish a competitive advantage.

From optimizing resource allocation to securing financing and navigating tax strategies, the income statement equips small businesses with the tools they need to achieve long-term financial health and growth. A well-maintained income statement, built on accurate data, is a powerful asset for any small business leader.