Cash Flow Statement

The cash flow statement is a financial report that summarizes a company’s sources and uses of cash (operating activities, financing activities, investing activities) over a period of time.

What is the Cash Flow Statement?

The cash flow statement, also known as the statement of cash flows, is a financial report that details the sources and uses of cash for a business over time. By reporting the cash flows into the business and the cash flows out of the business, the cash flow statement gives small business owners an idea of how their cash position changes over time. The cash flow statement is divided into three components to effectively monitor business activity across operating, investing, and financing activities. Cash flow statements are usually published monthly, quarterly, and annually.

There are two methods for reporting cash flows, the direct and indirect methods. The direct method specifically lists all of the cash receipts and expenditures a business incurred while the indirect method utilizes income statement and balance sheet data to adjust net income for non-cash activity.

The cash flow statement provides valuable insight into a company’s financial health, efficiency, and ability to generate cash. It should be evaluated along with the income statement and balance sheet to get a complete view of a company’s financial performance and future potential.

Key Discussion Points

The cash flow statement shows how a business generates and uses cash in its operating, investing, and financing activities over time.

The operating section reveals cash flow from core business functions like sales and expenses. The investing section details cash used to acquire or sell long-term assets (property, equipment). Finally, the financing section shows how the company's capital structure impacts cash flow through debt issuance, equity changes, and dividend payments.

By evaluating cash flow alongside the income statement and balance sheet, small business owners can gain a holistic view of the company's ability to meet financial obligations, invest in growth, and remain solvent.

KPIs including operating cash flow (OCF), free cash flow (FCF), free cash flow to the equity (FCFE), and cash flow coverage ratio (CFCR) provide business leaders with a deeper understanding of the company's cash flow efficiency and its ability to service debt obligations.

The effectiveness of the cash flow statement hinges on the accuracy of the underlying data. Utilizing accounting software and prioritizing meticulous record-keeping practices ensure reliable information while consistent review allows for early detection of potential issues, identification of emerging opportunities, and informed decision-making to steer the business towards its goals.

The cash flow statement provides small business owners and leaders with critical data that can be used to make decisions that impact short-term and long-term liquidity, the capital structure of a business, investment strategy, and capital allocation.

Consistently reviewing the cash flow statement can provide significant benefits to small businesses including:

Improved Liquidity Management - Understanding and predicting the timing of cash flows helps business owners ensure they have enough cash on hand to cover daily operations and short-term financial obligations, which is critical for remaining solvent.

Better Financial Planning - Business owners with a strong grasp on their cash flows can make smarter financial planning decisions by proactively making moves to alleviate cash shortages and establishing plans to invest surplus cash into future growth activities or distribute it to the business owners, depending on the organizational strategy and goals.

Early Warning System - Regular review of the cash flow statement allows business owners to be made aware of emerging financial issues before they become critical. This early detection can lead to timely interventions to avert potential financial distress.

Supports Credit Management - The cash flow statement can help business owners manage accounts receivable and accounts payable more effectively. Analyzing trends and timelines enables owners to strategize ways to collect receivables faster and negotiate better terms with suppliers.

Increased Ability to Attract Financing - Potential investors and lenders want to be sure the companies they give their money to are in the best position possible to succeed. A well-maintained cash flow statement demonstrates solid financial management, increasing the probability of obtaining any desired financing.

Optimizes Inventory Management - By tracking the cash impact of inventory purchases and sales, business owners can optimize inventory levels to free up cash without risking stockouts that could hamper sales.

As evidenced by the benefits outlined above, having an accurate, high-quality cash flow statement that receives regular review from management provides small businesses with critical insights and knowledge to make faster, smarter liquidity management decisions that will set the company up for future growth.

Why the Cash Flow Statement is Important for Small Businesses

What's Included in the Cash Flow Statement?

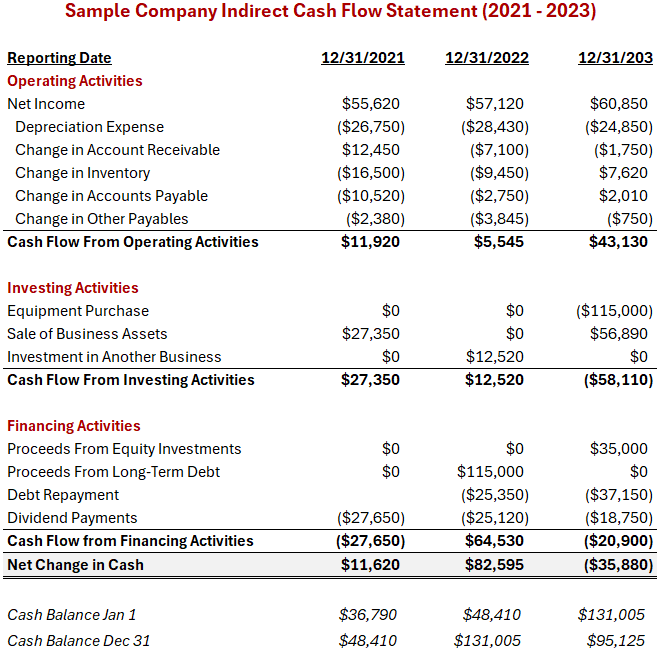

The cash flow statement breaks an organization’s cash flow activity into three key sections (operating, investing, and financing activities) that make it easy for business owners to identify the business activities that generate the most cash, and which activities need more attention. In the image below, it’s easy to see how cash flows are changing over time and which areas of the business are responsible for producing and consuming the most cash. We’ve provided examples of both direct (left) and indirect (right) cash flow reporting methods below.

Operating Activities

This section presents the company’s net change in cash during the reporting period due to regular operating activities. While it’s calculated differently for the direct and indirect methods of cash flow reporting, both methods should produce the same figures.

Direct Method: As you can see in the direct cash flow statement above, this method lists the specific cash receipts and disbursements during the reporting period. These totals are then added to calculate the cash flow from operating activities. Items that fall into this category include cash receipts from customers, purchases of inventory or merchandise, marketing and advertising expenses, salary and wages paid to employees, utility expenses, rent expenses, insurance expenses paid, etc. Anything reported above the operating income line on the income statement should appear here if it were a cash transaction.

The direct method provides more transparency into cash operations, making it easier for stakeholders to see the actual cash flows.

Indirect Method: Rather than list and tally all of a company’s cash transactions during the reporting period, the indirect method starts with the company’s net income and makes adjustments to remove the impact from non-cash activities including depreciation, amortization, and changes in net working capital. Depreciation and amortization expenses can be found on the income statement while changes in net working capital items can be calculated using the balance sheet.

We will use the change in accounts receivable to describe how to calculate the change in net working capital items. In this example, our sample company had a $1,750 cash outflow due to changes in accounts receivable for the year ending 12/31/2023. By examining the balance sheet (not pictured) we would find an accounts receivable balance of $105,500 for the year ending 12/31/2022 and a balance of $107,250 for the year ending 12/31/2023. By subtracting the 2023 balance of $107,250 from the 2022 balance of $105,500, we calculate our cash flow of ($1,750) for this item.

If the working capital item is an asset, subtract the current year-end balance from the prior year-end balance. If the working capital item is a liability, subtract the prior year-end balance from the current year-end balance. Remember, a year-over-year increase in working capital asset balances represents a cash outflow and a decrease is a cash inflow. A year-over-year increase in working capital liability balances represents a cash inflow and a decrease is a cash outflow.

Working Capital Asset Cash Flow = Prior Year-End Balance - Current Year-End Balance

Working Capital Liability Cash Flow = Current Year-End Balance - Prior Year-End Balance

In the two examples above, despite using different methods, we arrive at the same operating cash flows for each of the three years.

Which is better - the direct or indirect method?

The direct method provides more transparency into cash operations, making it easier for stakeholders to see the actual cash flows. However, the indirect method is more commonly used because it is easier to prepare from existing financial statements without additional accounting beyond the standard accrual-based records. Businesses utilizing cash-based accounting systems inherently use the direct cash flow method.

Investing Activities

The investing activities section of the cash flow statement reports on cash flows from the long-term use of capital in the business. This activity is unlikely to be reported on the income statement unless a gain or loss is tied to selling one of these assets. This investment activities cash flow is reported the same way whether the direct or indirect method is used. Only the operating activities portion of the cash flow statement is impacted by that distinction.

Investing activities reporting is important because it gives business owners insight into how the company is allocating its capital resources. If a company spends more on long-term assets, it’s commonly viewed as a commitment to growth and scaling existing operations. Cash received from divesting in assets can indicate a potential change in strategy and resulting changes in the company’s operations. Wisely made investments in equipment, land, or other businesses should impact future earnings, so measuring their performance over time gives an idea of how efficiently these dollars are being spent and if management is successfully executing their growth strategies.

Examples of items appearing in the investing cash flows section include:

Purchase or Sale of Property, Plant, and Equipment - These are purchases or the disposal of physical assets such as land, buildings, machines, vehicles, etc. used in the production of the goods and services.

Acquisitions and Divestitures - Cash outflows for the purchase of other businesses (acquisition) or the sale of existing business units (divestiture).

Purchase or Sale of Investment Securities - This would include stocks, bonds, or other financial instruments that are held long-term as part of the company’s investment portfolio.

Loans Made to Other Entities - Cash outflows related to loans made to other entities and cash inflows when these loans are repaid to the business.

Other Capital Investments - Any other capital expenditures incurred by the company will fall into this section of the cash flow statement.

Financing Activities

This final section of the cash flow statement reports on cash flows from activities related to the company’s capital structure by summarizing the cash movement between the company, its owners, investors, and creditors. The key components of this section include:

Issuance of Long-Term Debt - Cash flows received from taking out loans or issuing bonds. This activity increases the amount of cash on the company’s balance sheet while increasing the long-term liabilities.

Repayment of Debt - Any cash outflows related to the repayment of existing loans or outstanding bonds. Repaying debt will reduce the company’s leverage which can make it more appealing to investors and potential creditors in the future.

Issuance of Equity - Cash received in exchange for issuing new shares. New shares can be issued publicly or privately and dilute the value of existing shares, but they don’t require repayment like debt.

Repurchase of Equity - A company can also buy back equity that has been previously issued. Repurchasing stock is a cash outflow that increases the value of the remaining shares.

Payment of Dividends - Dividends are paid to shareholders periodically (usually quarterly or annually) and represent a cash outflow.

Cash Flow Analysis: Key Performance Indicators (KPIs)

The cash flow statement presents small business owners with valuable data and potential insights into the performance and management of the company, and its financial health. In this section, we’ll analyze some key performance indicators (KPIs) that small business owners can use to evaluate their organization:

Operating Cash Flow (OCF) - Measures the cash generated (or spent) by normal business operations excluding any secondary cash flow impacts such as investment activities or financing activities. This is a critical indicator of the company’s ability to produce enough cash flow from core operations to remain a going concern, achieve growth objectives, and fulfill financial obligations without additional financing.

Operating Cash Flow (OCF) = Cash Flow From Operations

Operating Cash Flow (OCF) = Net Income + Adjustment for Non-Cash Items + Changes in Working Capital

Free Cash Flow (FCF) - Another measure of financial health, Free Cash Flow (FCF) equals the amount of cash available after accounting for operating and investing activities. It represents the amount of cash available for discretionary purposes after capital expenditures and can signal problems with a company’s fundamentals before they become evident on the balance sheet or income statement.

Free Cash Flow = Operating Cash Flow - Cash Flow From Investing Activities

Free Cash Flow to Equity (FCFE) - Also called levered Cash Flow (LCF), FCFE represents the cash available to shareholders after a company fulfills its debt obligations. This is a good indicator of a company’s ability to repay debts and highlight any future risk of default. Net borrowing will be negative if debt is repaid, or positive if new debt is issued to boost cash reserves.

Free Cash Flow to Equity (FCFE) = Free Cash Flow (FCF) + Net Borrowing

Cash Flow Coverage Ratio (CFCR) - The cash flow coverage ratio shows small business owners the ratio of cash flow from operations to total debt. It’s a measure of the company’s credit risk and is key for potential creditors and investors as they evaluate the company. The higher the number is, the less risky the business is.

Cash Flow Coverage Ratio (CFCR) = Operating Cash Flow / Total Debt

By regularly reviewing the cash flow statement and these key metrics, small business owners can quickly identify any potential financial hurdles and make appropriate plans to address them. In addition, these reviews will provide management with a better understanding of the company’s financial health and operational efficiency. This can lead to more proactive and informed management decisions that drive growth and value for the company.

Tips for Maintaining a Quality Cash Flow Statement

Any cash flow statement will only be as good as the data provided and the maintenance practices employed by the company. A cash flow statement with incorrect or missing data is useless to a small business owner with the potential to significantly damage any credibility the business may have with investors or financial institutions.

Take the following steps to create and maintain an effective, accurate cash flow statement:

Use Accounting Software - Instead of spreadsheets, consider affordable, easy-to-use tools like Quickbooks or Xero for tracking income and expenses. These solutions automate tasks, reduce mistakes, and generate a professional-looking cash flow statement for your business.

Prioritize Accurate Record Keeping - Keep detailed records of all cash inflows and outflows (this is one of those tasks that can be automated by Quickbooks or Xero) to ensure the accuracy of the cash flow statement; find a system that keeps you organized with receipts, invoices, and financial documents.

Conduct Regular Reviews - check the cash flow statement regularly, preferably monthly, with the rest of your leadership team. Consistent review familiarizes leadership with operations helping to catch any errors, discover potential issues before they become serious problems, and recognize opportunities before it’s too late to act.

Use a Professional - As your business grows and accounting becomes more complicated, or you’re not much of an accountant to begin with, consider getting advice from a professional. They can give expert guidance, help with taxes, and offer tips to manage your finances better.

By incorporating these steps – utilizing accounting software, prioritizing record-keeping, conducting regular reviews, and seeking professional assistance when necessary – small businesses can ensure their cash flow statements are reliable and informative, empowering them to make sound financial decisions.

The Bottom Line

The cash flow statement is a vital financial report for small businesses. It provides a clear picture of a company’s cash health by detailing cash inflows and outflows from operating, investing, and financing activities. Keep a high quality cash flow statement by utilizing accounting software, consulting professionals, prioritizing accurate record keeping, and conducting regular cash flow reviews.

Regularly analyzing the cash flow statement empowers small business owners to make informed financial decisions that ensure the company’s short-term and long-term success. By understanding the cash flow statement and the associated key performance indicators (KPIs), small businesses can proactively manage their cash flow, identify financial risks and opportunities, and make data-driven decisions that propel the company towards its future goals.